- Blog

- |People management

- >Annual leave and absences

- >Maternity leave

Everything you need to know about maternity leave

Maternity leave is a statutory right for all female employees who are expecting or who have had a child. However, the intricacies surrounding the subject are often misunderstood.

Here's our comprehensive guide to maternity leave.

What is maternity leave?

Statutory Maternity Leave (SML) can be a maximum of 52 weeks and is split in two different parts; Ordinary Maternity Leave (OML) and Additional Maternity Leave (AML).

► Ordinary Maternity Leave

OML is the first 26 weeks of someone’s maternity leave. An employee is entitled to return to the same position they held directly after the end of their OML period.

► Additional Maternity Leave

AML begins the day after OML finishes. Once the AML period has finished, an employee can return to their role; however, if the employer deems it not viable for this to happen, then they must offer appropriately similar employment on the same terms as before and with the same level of seniority.

Who is eligible to go on maternity leave?

It may seem fairly obvious, but to go on maternity leave, the person in question must be an employee. This means that if someone is a contractor then they would not be entitled to any maternity leave or pay directly from the employer.

What do you have to do to be eligible for maternity leave?

An employee must provide a minimum of 15 weeks’ notice prior to the week that the baby is due (WBD). They must also inform their employer regarding when they would like the maternity leave to start.

What is maternity pay?

The terms of Statutory Maternity Pay (SMP) and Statutory Maternity Leave (SML) are often confused with each other.

The most significant difference between the two is SML is compulsory, while SMP is dependent on a couple of variables.

SMP is the pay that an employee receives when on maternity leave. In total, an employee is entitled to 39 weeks' pay with the first six weeks paid at 90% of the employee’s average weekly earnings (AWE).

The following 33 weeks are paid at the statutory weekly rate (£151.97) or 90% of the employee’s AWE, whichever is lower.

While these are the legal requirements regarding maternity pay, a significant number of companies continue paying their employees more than these amounts throughout their maternity leave. This is referred to as Occupational Maternity Pay (OMP) and is down to the discretion of individual companies.

Furlough and maternity pay

If an employee has been on furlough during the relevant period used to calculate average weekly earnings, then the amount to use for calculating their maternity pay entitlement will be the higher of:

what was actually received during the pay period;

what they would have received had they not been on furlough leave

Who is entitled to maternity pay?

Employees who have been employed in a company for at least 26 weeks before the 15th week, otherwise referred to as the qualifying week, prior to the baby’s due date are entitled to SMP. If someone does not meet the criteria, then the employer would be within their right not to offer any.

An employee must have received average weekly earnings of at least the lower earnings limit (currently £120) per week during the relevant period. The relevant period is the eight weeks prior to the 15th week before the baby is due.

Finally, an employee must also provide proof of pregnancy either in the form of a MAT B1 or a letter from their doctor or midwife.

What if an employee does not meet the criteria for maternity pay?

If an employee is not entitled to maternity pay and if the employer refuses the request, then the employee may still be entitled to receive Maternity Allowance (MA).

In this event, the employer must return MAT B1 form to the employee along with a signed SMP1 form within seven days of having taken their decision. An employee must receive this form within 28 days of their request for SMP, or the birth of the child, depending on whichever occurs earlier.

The employee can then take this to their local Jobcentre Plus and try and claim their MA.

Salary increases and maternity pay

If an employee has been awarded a salary increase any time between the relevant period and the end of the maternity pay period, they must have their average weekly earnings recalculated based on the higher salary.

This is also the same if a salary increase is awarded during the relevant period. In this case, the higher salary must be used.

Keep In Touch (KIT) days

An employee on maternity leave is entitled to up to 10 KIT days. A KIT day means that they are able to return to work and be paid for that day.

They can be taken separately or together and the employee is paid the full daily rate. The days cannot be split into half days, which means that if an employee returns for half a day it will still count as a full day.

🗓 Notice periods

Leave

An employee must confirm their maternity start and end dates 15 weeks before the baby is due. However, they can amend their return to work date if they provide a minimum of eight weeks’ notice.

Pay

An employee must give 28 days’ notice from when they wish to start receiving SMP. An employer can refuse SMP if the employee doesn’t give proper notice, except for in the instance in which the employee is able to justify the reasons for not doing so.

Maternity leave - key terms:

| Key Terms | What it means |

|---|---|

| SML | Statutory Maternity Leave |

| SMP | Statutory Maternity Pay |

| OML | Ordinary Maternity Leave |

| AML | Additional Maternity Leave |

| WBD | Week Baby Due |

| AWE | Average Weekly Earnings |

| OMP | Occupational Maternity Pay |

| MA | Maternity Allowance |

| KIT days | Keep In Touch days |

| Qualifying Week | The 15th week before the WBD |

| Relevant Period | The eight weeks before the qualifying week |

🎤 💥 Myth-busting

Myth No.①

My boss says I need to take 52 weeks’ leave. Is this true?

Fact 🔥

No. You have to take a minimum of two weeks’ leave after your baby is born (four if you work in a factory), but you do not have to use up your entire 52 weeks.

Myth No.②

I have just joined my company, but my employer says I am not entitled to maternity leave.

Fact 🔥

You are entitled to maternity leave, but you may not be entitled to maternity pay. If you’ve not been at the company for the required time, your employer is within their right not to provide you with maternity pay. However, you may still be eligible to receive your Maternity Allowance.

Myth No.③

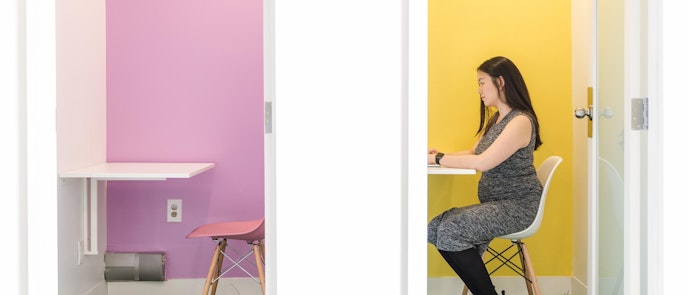

My employer says I don’t accrue annual leave while I’m on maternity leave as I’m off work anyway.

Fact 🔥

You are still entitled to your standard annual leave entitlement. If you are unable to take all your annual leave days during the leave year due to being on maternity leave, then you can carry the days over into the next leave year.

Myth No.④

I can start my leave at any point during my pregnancy.

Fact 🔥

Maternity leave can start no earlier than 11 weeks before the WBD. If you’re off sick due to a pregnancy-related illness within four weeks of WBD, your maternity leave will automatically start on that day.

PayFit & maternity leave

The PayFit app allows users to automatically calculate maternity pay.

Users must enter the date that the employee will begin their leave and the app will then automatically calculate the statutory amount that they should be paid as well as the amount that the company can reclaim to cover the costs.

The app also gives you the opportunity to set up OMP allowing you to set up a policy where you can pay more than the legal minimum to your employees.

For example, should you wish to pay all employees 100% of their salary for the first 10 weeks of maternity leave, and then subsequently pay 50% for the remainder of their leave, then you are able to do so through the app.

Once all this has been set up, PayFit will automatically calculate the correct amount each time one of your employees goes on maternity leave.

Interested in finding out more about how PayFit can help automate your payroll and HR processes? Why not book a demo with one of our product specialists?

PayFit disclaimer

The information contained in this document is purely informative. It is not a substitute for legal advice from a legal professional.

PayFit does not guarantee the accuracy or completeness of this information and therefore cannot be held liable for any damages arising from your reading or use of this information. Remember to check the date of the last update.

UK Expenses Management - A Guide For Employers

Overtime Pay Rates & Laws in the UK

The 2024 UK National Living Wage - An Employer’s Guide

The Cost Of Recruitment In The UK - What You Might Not Know

UK National Insurance Changes for January 2024