- Blog

- |Managing Payroll

- >Payroll

- >correcting payroll errors

New Feature in Focus - PayFit’s ‘Undo Payroll’ Feature

We all make mistakes. It happens, we’re human after all. Even the UK’s HR and payroll professionals, - who are meticulous thinkers and problem solvers if we do say so ourselves - make mistakes from time to time.

But errors made when running payroll can create a knock-on effect that impacts not just the employee(s) in question but also the paying and reporting of tax liabilities, plus long-term budgeting and forecasting. Payroll errors create unhappy employees, cause unnecessary extra work and stress, and can lead to penalties, fines and unwelcome attention from HMRC.

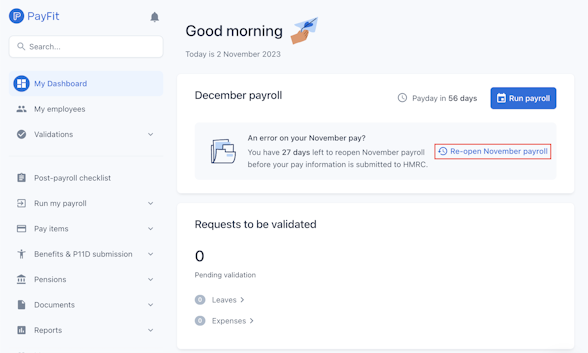

But now, PayFit Premium users can take advantage of our new undo payroll feature, a simple way of correcting UK payroll errors with a few clicks. Missing changes can be made before once again closing payroll for the month, with new payslips automatically generated for any employees whose pay has changed. Think of it like Tipp-Ex for your payroll or, better yet, a delete key.

Find out all about this super new feature, why we created it, how it works, risks to be aware of and how payroll teams can get their hands on it.

Why was undo payroll created?

Every month, around 5% of the support requests received by our UK Customer Success team involve requests from our customers to re-open their payroll. Common reasons for these payroll correction requests include the customer forgetting to enter a bonus, or a new starter or a leaver.

We identified some common problems our UK customers encountered when considering how to correct payroll errors, blockers that might have prevented this process from being straightforward before this new release.

Firstly, there was an issue with complexity, or a lack of knowledge, with specialised expertise required to correct certain payroll errors. This could lead to frustration and delays when the required skills aren’t in place.

Secondly, some users waiting for support requests to be processed were experiencing delays across their wider HR processes as a result. They found that correcting payroll errors was a lengthy process, and close to payroll deadlines this was leading to rushed decisions and incomplete or incorrect actions elsewhere.

As saving businesses time is PayFit’s raison d’etre, we had to live up to our principles and develop a simpler way of making changes.

Step forward, undo payroll!

How does the undo payroll feature work? What does it include?

The undo payroll feature allows you to undo your last run payroll in just one click. You can make any missing changes before closing your payroll again for the month. It takes seconds to complete, allowing users to re-run payroll up to the day before payday (i.e.: after you would have usually closed payroll and made any final adjustments).

Payslips are regenerated for any employees whose pay has changed, and all documents and reports (pension files, payroll journals etc.) will be regenerated based on the new Run Payroll. Any original documents are archived in a separate folder, meaning you can refer back to them at a later date to remind yourself which errors were originally made.

The payroll correction process is initiated by clicking a new button within PayFit that re-opens a recently closed payroll. Users then have the option to select the type(s) of corrections they’d like to make, download a list of additional payments to make (for any payments that may have already been sent to payment providers) and finally to make the desired changes and run payroll once more.

(It’s important to note that users should click ‘reopen payroll’ rather than run payroll, otherwise you won’t be able to re-run payroll for the month you require.)

What are the potential risks or challenges associated with re-running payroll?

There are some things to be aware of when considering how to correct payroll errors. Essentially, re-running UK payroll should be the exception rather than the rule, as it comes with some risks and complexities that admins need to be aware of.

Human error

Making manual corrections to payroll can introduce new errors, such as incorrect pay rates, hours, or deductions. These mistakes can lead to additional payroll inaccuracies and frustrated employees.

Delayed payments

Correcting payroll errors may cause delays in employee payments, affecting employee morale and potentially leading to legal issues if employees are not paid on time. This is one of the reasons why we only allow Undo Payroll before payday, so pay runs remain compliant.

Compliance issues

Making changes to payroll data could result in non-compliance with UK tax and employment laws, or other HMRC-related requirements. Any corrections made should adhere to the relevant regulations to avoid penalties or fines. Thankfully, PayFit has the most up to date payroll rates and legislation hardcoded into the platform, triggering a visible alert should any corrections take you into hot water territory.

Increased complexity

Allowing admins to correct payroll can increase the complexity of the payroll process. This may lead to confusion or errors, particularly if multiple adjustments are made over a short period or if multiple admins are involved. Make sure that you have a clear line of approval with any admins on your team as to who can make changes and when.

Communication challenges

Informing employees about payroll corrections and ensuring they understand the changes made can be challenging. Poor communication may result in confusion, mistrust, or dissatisfaction among employees.

All of this being said, PayFit’s expert customer support team will be on hand at every step of the way. And as part of our Premium plan that includes undo payroll as standard, you’ll be able to take advantage of a live chat feature, dedicated personal account manager* and a call back service*, so the brightest brains in payroll are never more than a few clicks away.

*companies with more than 25 employees

How can I get my hands on the undo payroll feature?

If you’re already a PayFit Premium plan customer, undo payroll will have appeared in your dashboard already. If you’re using either our Light or Standard package, your Customer Care contact would be happy to discuss the benefits and value of moving up to Premium, including undo payroll as part of the package.

To find out more about how PayFit helps revolutionise payroll and HR processes for over 10,000 businesses, book in a demo of the platform with a member of the team below.

UK Expenses Management - A Guide For Employers

Overtime Pay Rates & Laws in the UK

The 2024 UK National Living Wage - An Employer’s Guide

The Cost Of Recruitment In The UK - What You Might Not Know

UK National Insurance Changes for January 2024