- Blog

- |Managing Payroll

- >Payroll data

- >data-driven culture and payroll

Building A Payroll Data-Driven Culture Across Your Organisation

Being able to derive meaningful and useful information from data, and apply this to roles, responsibilities and wellbeing in the workplace, is an empowering skill for UK teams to have. Because after all, making decisions based on facts and evidence, rather than ‘finger in the air’ thinking, or a ‘hunch’, inevitably leads to better outcomes both for individuals and the wider business.

This is the power of a data-driven culture in a nutshell.

When it comes to matters concerning payroll, building a data literacy program, especially across HR and Finance teams, is crucial to bringing greater value to any UK business. Indeed, by including all other employees within a data-driven culture initiative that includes payroll data, you can help empower them to make better personal and business decisions.

In this article we’ll show UK HR and Finance teams overseeing people and payroll how to improve data literacy, as well as why creating a data-driven culture is so important.

What do we mean by ‘payroll data’, and what can specific individuals gain from it?

When we talk about payroll data, we’re referring to all the information that can be collected from not just payroll processes and software but also associated elements such as annual leave, expenses and performance.

Having readily available access and understanding of this information is hugely beneficial both for UK decision-makers within HR, Finance and Strategy teams, as well as the employees to whom the information relates. When considering how to build data literacy in your company, payroll and associated data should be at the heart of it.

But before we go into the why, let’s take a look at what payroll data encompasses and what different members of the business can gain from being data literate in each element.

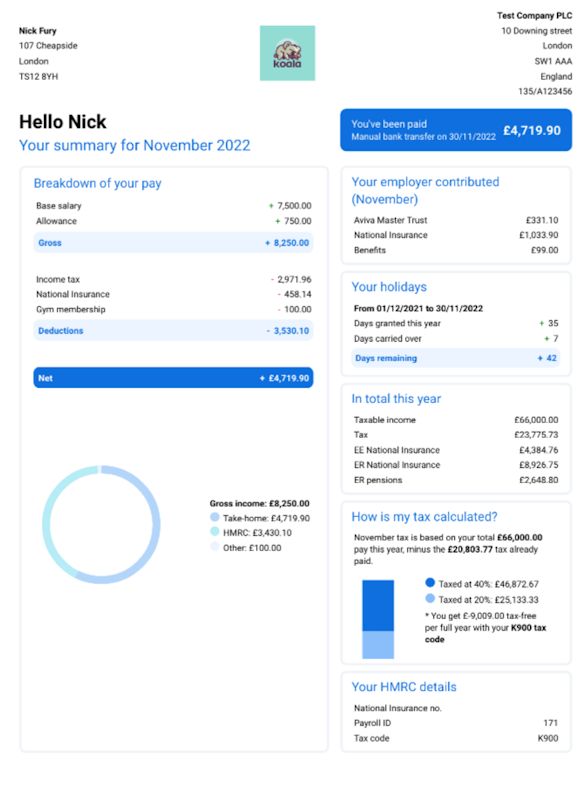

Payslip information

For a UK employee, understanding exactly what’s on their payslip, and how it all contributes towards net pay, can be surprisingly powerful for them. In a society that seeks to promote financial data literacy, responsibility with money and the importance of saving into a pension, the more an employee knows about deductions, contributions and earnings, the more financially confident they are likely to feel.

Improving data literacy from a payroll perspective starts with presenting all of the elements on a payslip to employees in a clear, easy to understand yet thorough manner.

PayFit’s payslip has been designed to clearly show a breakdown of pay, including base salary, pensions and any expenses, deductions, annual leave taken and available, year-to-date totals and HMRC details such as NI number and tax code.

This level of granular detail is designed to help employees make better-informed work-related and personal decisions, for example, amendments to pension contributions and student loan repayments or to present detailed information to prospective lenders to increase the chances of a mortgage or loan being granted.

And for Finance and HR departments or company directors, having a record of all employee payslips and access to payroll reports means being able to see how each deduction, contribution or gross/net earning impacts upon the bottom line, or how much must be paid to HMRC.

Performance data

More and more payroll software platforms are incorporating performance management modules into their setup. Employees are therefore able to access past 1:1s, reviews and objectives in one place, promoting not only a performance data-driven culture, but also one of accountability and feedback, with performance data easily accessible from anywhere.

HR teams will be able to use performance data reports to identify particular individuals or teams that may require additional support, or to see elements such as happiness or wellbeing scores and to know when and where to take action. Overall this will improve employee retention rates, help individuals to grow and develop more quickly and to help managers prioritise ‘at risk’ individuals more effectively.

The Finance department may wish to see which teams or individuals are over or underperforming, when budgeting for pay increases and bonuses.

Leave

Being able to see what annual leave they have available, the dates of upcoming time off, plus when other members of the team are on leave gives both employees and managers a clear picture for personal and workplace planning.

HR will find it beneficial to have a holistic view of any teams or individuals that use more sick days than others, which can help inform the need for additional health & wellbeing initiatives.

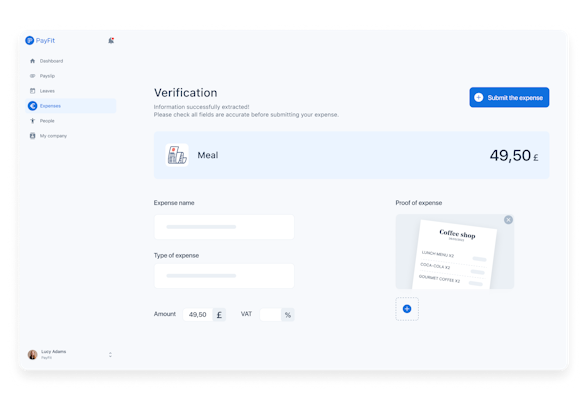

Expenses

Payroll software such as PayFit’s offers powerful expenses reporting capabilities, a key component of data literacy programs for Finance departments in particular. By enabling Finance to see the types of expense payments in a given time period, for example, subsistence, travel or equipment, and the number of claims, this allows the team to see the evolution of expense payment amounts and types over time.

This information could be used to decide whether or not to amend travel expense allowances, for example, if a particular employee or team had claimed a lot within other categories instead, and there may be some wiggle room. And as part of a wider data-driven culture drive within budgeting and forecasting, having access to such granular expense reports allows the team to get laser-focused with the whole process.

Costs per employee

It’s powerful for Finance departments to be able to get a breakdown of the cost per employee, as well as the total cost of all employees across either specific months, or the tax year to date. Better still, is to see this in an itemised fashion, that is to say the amount of tax, NI, pension contributions, benefits etc. that contribute towards the overall cost, both at a company wide and individual employee level.

Workforce demographics

An important data literacy program initiative for HR teams, particularly where E, D & I is concerned, being able to effectively assess workplace demographics, and how they are evolving over time, is a powerful workplace planning tool.

PayFit, for example, allows HR leaders to look at how the workforce is evolving over time, in terms of headcount, vs. the male / female split, company age profile, and gender pay gaps. This helps to inform recruitment strategies, salary adjustments and gender pay gap reporting.

HMRC payment records

It’s essential for Finance to know exactly how much income tax, NIC and student loan payments are due to HMRC, and when. This degree of data literacy and insight ensures there’ll be no nasty late payment fees or penalties later down the line.

Why is promoting a data-driven culture important?

It’s not sustainable for any decision-makers, or indeed any employees choosing to take a particular action in the workplace, to rely on assumptions or gut feelings. Processes quickly become more efficient and effective when they are informed by reliable data, and teams are empowered to use business insight to drive decision-making.

Fostering a data-driven culture adds a degree of certainty over outcomes that can help ease stresses and strains on teams working on cross-departmental projects, as guesswork usually means having to do something more than once, adding time and pressure to stretched teams.

Having access to accurate data helps to improve employee engagement and trust in leaders, especially when it comes to matters surrounding pay and performance.

What are the benefits of creating a data-driven culture?

When it comes to matters concerning payroll, building a data literacy program, especially across HR and Finance teams, is crucial to bringing greater value to the business. Indeed, by including all other employees within a data-driven culture initiative that includes payroll data, you can help empower them to make better personal and business decisions.

People don’t like to be kept in the dark when it comes to matters concerning their pay and performance. By making all the relevant information clear and transparent, and easily accessible, this encourages employees to keep up to speed with everything.

And thus a data-driven culture starts to take shape.

The benefit of doing this from an employee perspective is that it enables them to take greater ownership of financial matters, be aligned on performance goals and objectives with their manager (and keep regular track of progress), plus know when annual leave is on the horizon and how much they have left to book.

These elements of data literacy and culture are further helped when staff have access to an all-in-one cloud-based software where everything can be accessed from anywhere,and is linked to actionable email reminders and deadlines.

From a decision-makers perspective, especially in HR and Finance teams, having access to customisable payroll and company reports that allow them to generate and analyse data according to specific needs is hugely valuable.

By having real-time access to accurate data, users can make informed decisions based on the most up-to-date information. Embedding a data-driven approach at all times helps users to effectively understand and interpret the payroll and employee data available to them.

To find out more about how PayFit can help to build data literacy in your company, and embed a data-driven culture throughout your teams, book in a short demo of the platform with one of our product specialists.

UK Expenses Management - A Guide For Employers

Overtime Pay Rates & Laws in the UK

The 2024 UK National Living Wage - An Employer’s Guide

The Cost Of Recruitment In The UK - What You Might Not Know

UK National Insurance Changes for January 2024