- Blog

- |Managing Payroll

- >Payroll

- >PayFit's top features

PayFit's Most Popular Features

With more improvements made to our platform over the past year, we thought we’d provide another roundup of PayFit’s most popular features.

From user-friendly workflows to market-leading integrations, custom reporting and more, we’ve been busy making PayFit the best it can be. So let’s dive into some of the features our customers are currently loving the most.

5 features our customers love

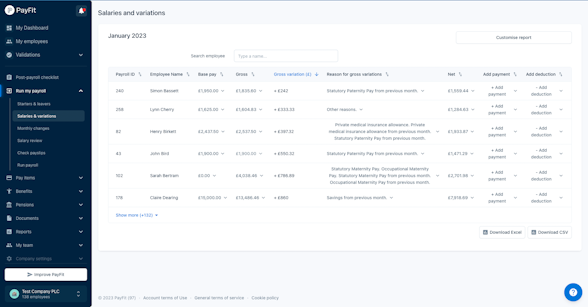

Run My Payroll (including variance dashboard)

This one goes down a treat whenever we show it during walk-throughs.

Run My Payroll takes you through all stages of running payroll, reducing monthly admin to a few swift clicks. Broken down into six easy-to-follow steps, you can review everything from starters & leavers to monthly changes like SSP payments before checking payslips and running payroll.

See this as your draft payroll for the month; the great news being you can make adjustments right up to payday!

Starters and leavers are automatically pulled through while pro-rated salary, PILOH and PILON are calculated behind the scenes. You’ll then get to review any changes for that month (think student loan deductions and tax code changes). These instantly update and are reflected on payslips.

Finally, the salary review includes our popular variance dashboard, where you can look at the previous month and compare it to the current one. No more digging through spreadsheets to spot the difference.

The result? More visibility and control over your monthly process and less confusion.

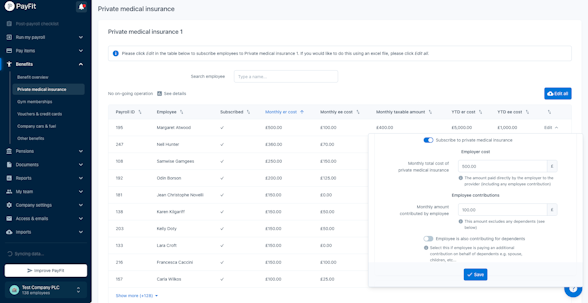

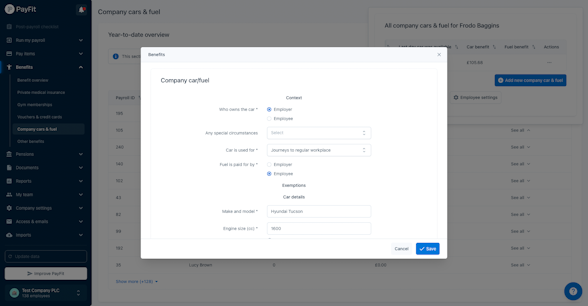

Benefits

Another aspect of our platform customers rave about. While other providers charge additional costs to process benefits, we include these free of charge. In addition to this, we cover a wide range of schemes from Cycle to Work to things like life insurance and training & development.

It can be a bit daunting to report all these benefits to HMRC, especially if you’re not totally familiar with the benefits process. Not to forget, processing benefits and reporting these on your P11Ds can be a very manual and time-draining experience.

That’s where PayFit comes in clutch. We automatically process your benefits for you and can submit P11Ds on your behalf to HMRC, making quick work of all that end-of-tax-year admin.

Resource: Can’t seem to get your head around benefits? Here’s a handy breakdown of Benefits in Kind for Employers.

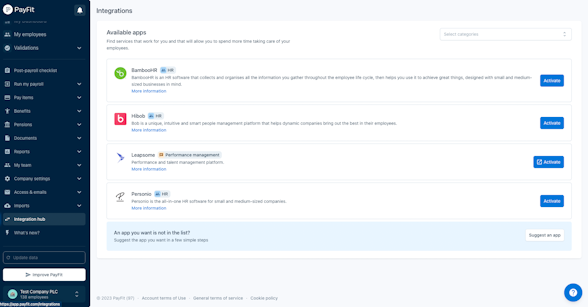

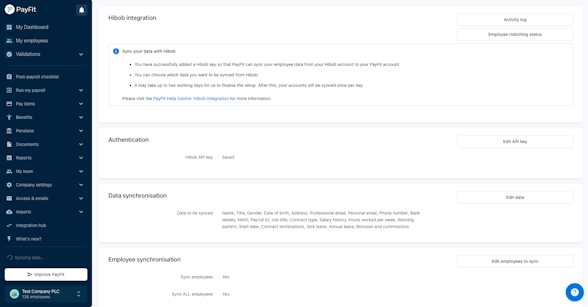

Integrations

We cover this in our roundups, time and time again, and for good reason; we’re firm believers that any payroll platform is only as good as the integrations it supports.

In other words, having different systems, like HRIS and payroll software, that can talk to each consistently reduces the need for redundant data entry.

Over the years, we’ve spent a lot of time on compatibility. As a result, we have some of the most sophisticated API integrations in the marketplace. Whether it’s syncing up with leading HRIS like BamBooHR, Personio or PeopleHR or working with the best accounting solutions, we’ve sorted it.

We also sync with a number of leading pension providers, from Aviva and Nest to People’s Pension.

Custom reports

One of our most popular features is the custom report. That’s right: you can use PayFit to track payroll data to uncover trends and supercharge your decision-making.

Our custom reporting feature allows you to pull out any data that comes through PayFit as a report. You can run a report at any time in just a few clicks based on over 319 different dimensions and download these as a PDF or CSV file.

Whether you’ve got a small or large amount of payroll data, there are so many insights to be gleaned from the simple act of tracking payroll metrics. This can help reduce costs, reveal areas for improvement (such as around gender pay disparity) as well as promote a better understanding of your business and its needs.

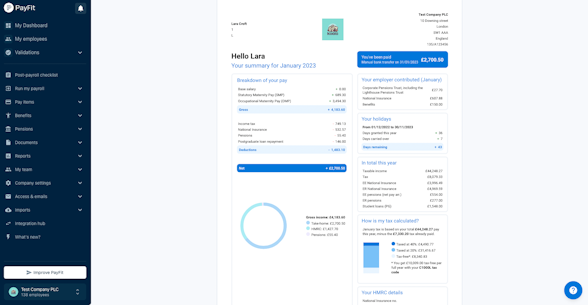

Employee accessibility

Finally, there’s the fact that PayFit provides excellent employee accessibility.

This isn’t really a feature, per se, as much as it’s something we’ve simply always done. Empowering employees by helping them to understand their payslips better is at the core of our mission. To stand by this, we make payslips as accessible as possible.

Each employee gets their own portal, where they can review and download any previous payslip. They can also access and download other employment documents like their contract, P60s and P11Ds.

The best part? Employees have access to the PayFit platform through their login for up to 30 years, which means they’ll still have access to their payslips even when they leave.

And some honourable mentions

In addition to the major features above, here are a few other aspects of our platform we felt would be great to highlight…

One-to-ones

PayFit is so much more than ‘just’ a payroll platform. The one-to-one tool is just one of many great HR features. It provides a template for managers and employees to catch up every week. Use the template to discuss performance, growth and future career opportunities.

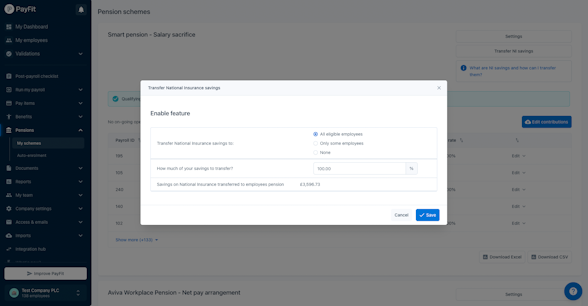

NI savings + salary sacrifice

Salary sacrifice allows employees and the employer to pay less/ NI. The good news is PayFit enables this employee-friendly policy. In other words, if you want, you can transfer more money back to your employees, which can help out with things like Cost of Living and overall wellbeing.

Post payroll checklist

This last step on the Run My Payroll workflow is an optional one. Nevertheless, it’s pretty nifty. Use this checklist to double, triple check you’ve done everything you need to before running your monthly payroll (and achieve total peace of mind).

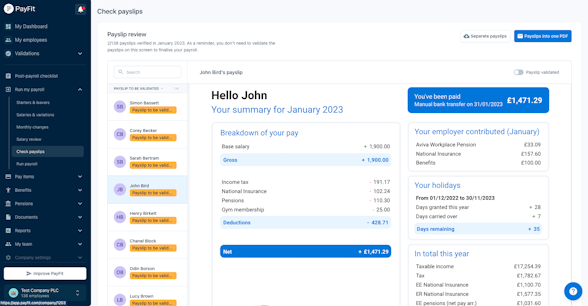

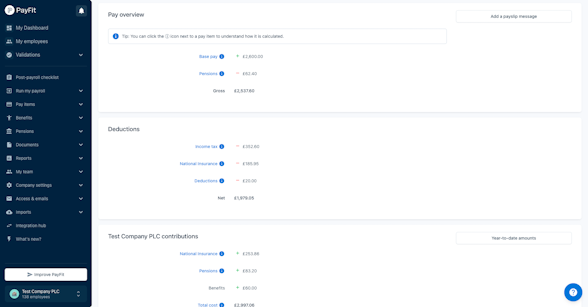

Payslip breakdowns

Last but certainly not least is payslip breakdowns. Available in your employer portal, these come in very handy when fielding questions from employees on tax, NI, student loan deductions and pensions.

Want to see these features in action? You can see all of these, and so much more, during one of our brilliant product walkthroughs. Schedule a demo, and we’ll tailor your session to your organisation's needs.

UK Expenses Management - A Guide For Employers

Overtime Pay Rates & Laws in the UK

The 2024 UK National Living Wage - An Employer’s Guide

The Cost Of Recruitment In The UK - What You Might Not Know

UK National Insurance Changes for January 2024